how to avoid paying nanny tax

First depositing pre-tax money from your paycheck lowers your gross income. Usually thats enough to take care of your income tax obligations.

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

To cover yourself register with your state tax department using a valid TIN and prepare to collect sales and other taxes when required.

. Put 20 down when buying a home. λέξις word designates the complete set of all possible words in a language or a particular subset of words that are grouped by some specific linguistic criteria. There are many reasons to pay your nanny legally.

Similar to your federal taxes you can file your state taxes late as well. To avoid an end-of-year tax bill or penalties for not paying taxes as you earned your income. These professionals have an in-depth knowledge of tax regulations tax management and tax planning.

No I dont think anyone should pay 250hr or anything but everyone here is acting like the mom is the problem but really the system is designed this way. This is one of the most beneficial and unused Self Assessment expenses you should be claiming as a business owner. I hate seeing these posts in particular.

You told us that you live in New York and the penalties in that state mirror those of the IRS. These money rules of thumb can be. If youre paying your household employment taxes using Schedule H to avoid an estimated tax penalty based on your household employment taxes you can.

She isnt asking for a college educated nannymaidchef. Youll also need to file a Form W-2 Wage and Tax Statement and furnish a copy of the form to your nanny and Social Security Administration. How to estimate your quarterly taxes.

Learn more about how to fill out. In January 1993 Clintons nomination of corporate lawyer Zoë Baird for the position came under attack after it became known that she and her husband had broken federal law by employing two people who had. In linguistics the term lexis from Ancient Greek.

ACTEC Fellows Jean Gordon Carter and Toni Ann Kruse explain what is considered a gift by the IRS the dos and donts of paying another persons tuition or medical bills what qualifies as tuition and medical expenses and practical examples. If you are using traditional accounting HMRC allows you to claim for any amount of money included in your turnover that you arent planning to receiveThis is known as a bad debt and the only real prerequisite for. In addition if you bought your business you may have to pay additional taxesand you may also be eligible for tax credits.

While you can avoid hefty fines and penalties for non-compliance by paying on the books and attract high-quality candidates to your job you can also take advantage of tax savings through a Dependent Care Flexible Spending Account FSA. By planning ahead firms can avoid paying excessive taxes. Paying for someone elses tuition or medical bill is an exception to the gift tax if you do it correctly.

The amount withheld is based on what you claim when you fill the form out. But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until. The taxes you pay may also depend on your business structure.

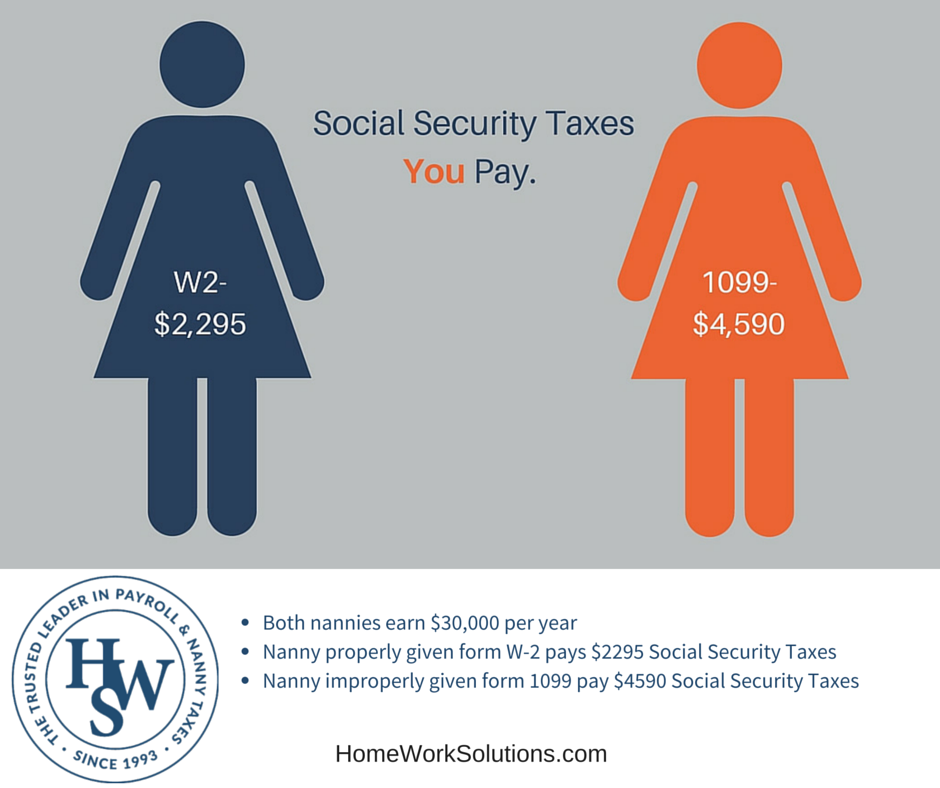

Nannygate is a popular term for the 1993 revelations that caused two of President Bill Clintons choices for United States Attorney General to become derailed. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver. If you claim too little tax liability you might end up having to pay the IRS at the end of the year.

Keep child care expenses below 10 of your annual household income. Tax Benefits of a Flexible Spending Account. By doing this you can even lower your tax rate.

For example the general term English lexis refers to all words of the English language while more specific term English religious lexis refers to a particular subset. Revenues of 320K fell below consensus of 000000. Of course this depends on where your annual income falls within your tax bracket.

If you claim more than you owe youll get a refund. Aug 31 2022 Must withhold your own taxesEmployers like contractors because they can avoid paying for taxes and benefits meaning those costs fall entirely on independent contractorsIndependent contractors have to pay Social Security and Medicare for both the employer and the employeeAs a business the contractor can deduct certain expenses on this. 5 of the unpaid taxes per month for filing late up to 25 and a penalty of.

Regardless of the FSA account type their pre-tax nature can result in many financial benefits. You pay federal income taxes on a pay-as-you-go basis. The burden is on you to pay estimated taxes four times a year April 15 June 15 September 15 and January 15 of the following year to cover your anticipated tax bill.

Dont spend more than 30 of your income on housing costs. EPS of -0193 missed the consensus estimate of -0180-556. Learn about making estimated quarterly tax payments to avoid a big tax headache when you file.

The more tax liability you claim the more in taxes are withheld and visa versa. HTL missed on both the top and bottom line. Tax consultants and chartered accountants decrease tax liability by using various deductions credits government subsidies and exemptions approved by the Internal Revenue Service IRS.

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. It appears shes just poor. Underpaying your taxes triggers a penalty while overpayment is the equivalent of giving the.

5 Easy Ways To Reduce Your Nanny Taxes

Hobbies That May Help Your Nanny Career Nanny Hobbies Hobbies And Interests

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Given A 1099 Fights Back

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Everything You Need To Know About How To Pay A Nanny In 2022

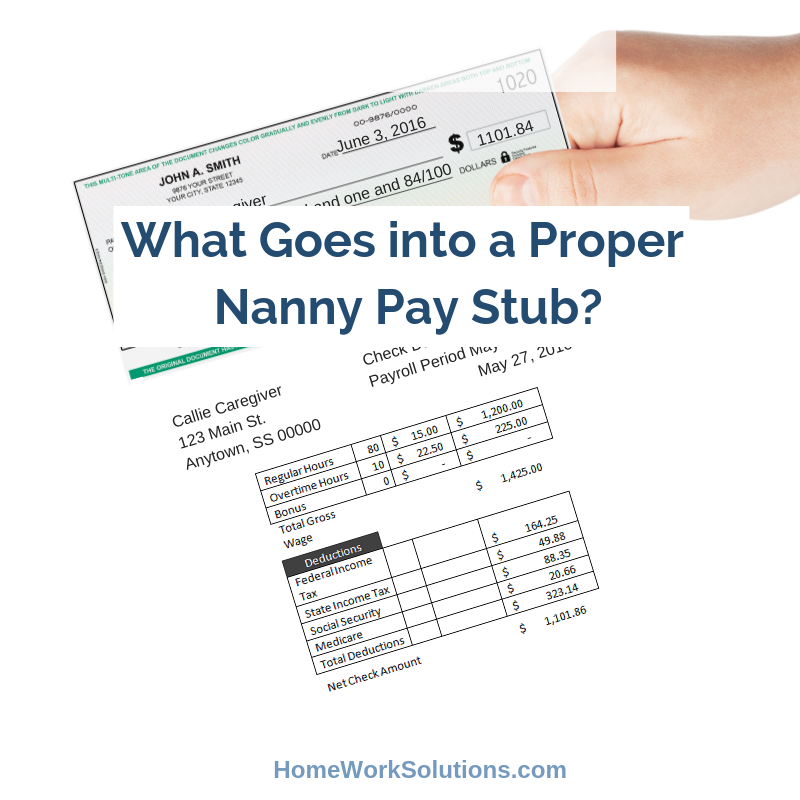

Explore Our Image Of Pay Stub Template For Nanny For Free Payroll Template Printable Checks Templates

Nanny Household Employment Tax Who Owes It Taxact

Babysitting Taxes Usa What You Need To Know

Nanny Payroll Part 3 Unemployment Taxes

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

The Differences Between A Nanny And A Babysitter

What Goes Into A Proper Nanny Pay Stub

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Nanny Payroll Services For Households Adp

Nanny Tax Do You Have To Pay Taxes For A Caregiver Internal Revenue Code Simplified

Cancellation Policies Minimum Hours And Holiday Rates For Sitters Babysitting Jobs Babysitting Babysitter

.png?width=250&name=W-2_(1).png)