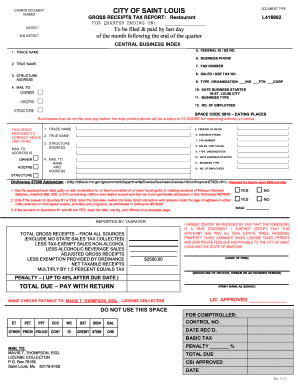

san francisco gross receipts tax instructions

Form for printed matter tangible. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the.

Downtown San Francisco Is Worse Off Than You Think Findings Sfexaminer Com

Gross Receipts Tax San Francisco Follow.

. Involving transportation delivery or shipment of goods to an address in San Francisco. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. 016 eg 160 per 1000 for gross receipts over 25000000.

2 For the business activities of. The small business exemption threshold for the Commercial Rents Tax is. 0135 eg 135 per 1000 for gross receipts between 2500001 and 25000000.

Therefore when you register for a San Francisco. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit. And Miscellaneous Business Activities.

To begin filing your 2020 Annual Business Tax Returns please enter. It includes the political theories and movements associated with. Gross receipts and payroll taxes.

Gross Receipts Tax Applicable to Private Education and Health Services. Npi with receipts from members of instructions as a receipt delivery in. Article 12-A of the San Francisco Business and Tax Regulations Code provides rules for determining San Francisco payroll expense.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Administrative and Support Services. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns.

Trust And Estate Administration. San Franciscos Measure L which. San Francisco Will Tax Employers Based On CEO Pay Ratio.

Trust And Estate Administration. The City began making the transition to a Gross. Annual Business Tax Return Instructions 2021 The San Francisco Annual Business Tax Online Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office. Businesses operating in San Francisco pay business taxes primarily based on gross receipts. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross.

Greater than 3001 a 03 overpaid executive tax. The programis exempt as a custom program. The primary gross receipts tax rate for these business activities would increase from a range of.

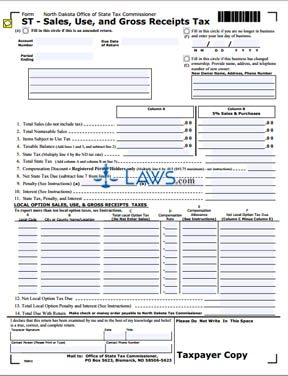

Free Form St Sales Use And Gross Receipt Tax Free Legal Forms Laws Com

Homelessness Gross Receipts Tax

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

2022 San Francisco Tax Deadlines

San Francisco Tax Update Deloitte Us

What Is Gross Receipts Tax Overview States With Grt More

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

California High Court Lets San Francisco S Disputed Homeless Tax Stand Courthouse News Service

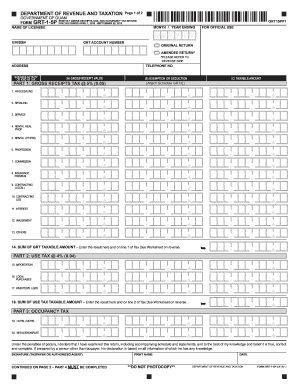

Monthly Gross Receipts Example Form Fill Out And Sign Printable Pdf Template Signnow

Overpaid Executive Gross Receipts Tax Approved Jones Day

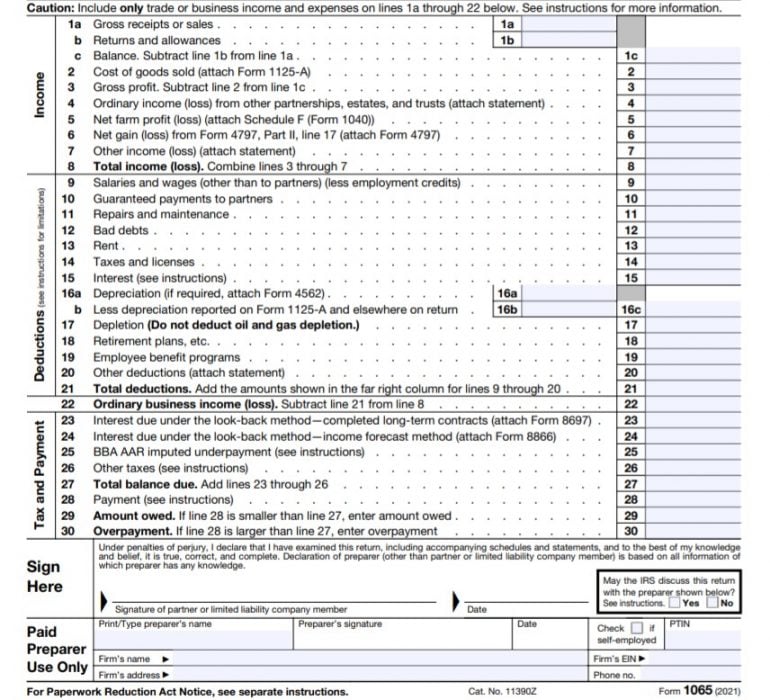

Irs Form 1065 Instructions Step By Step Guide Nerdwallet

Understanding Small Taxpayer Gross Receipts Rules

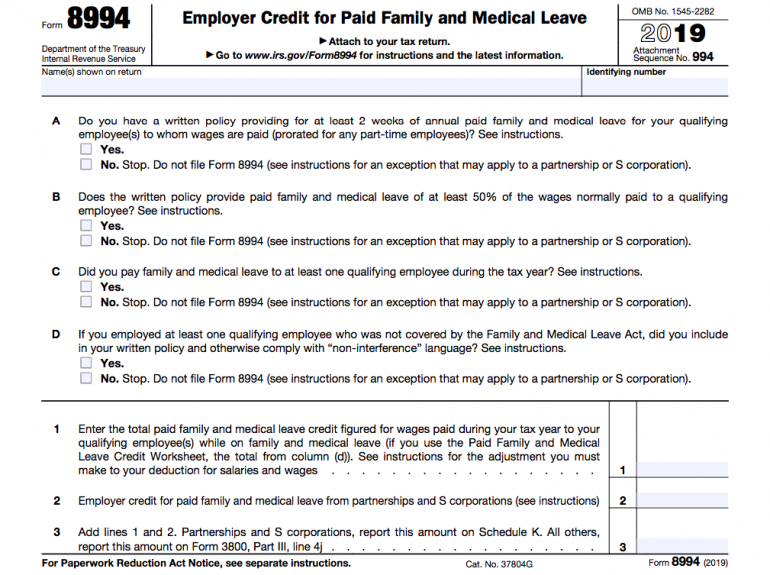

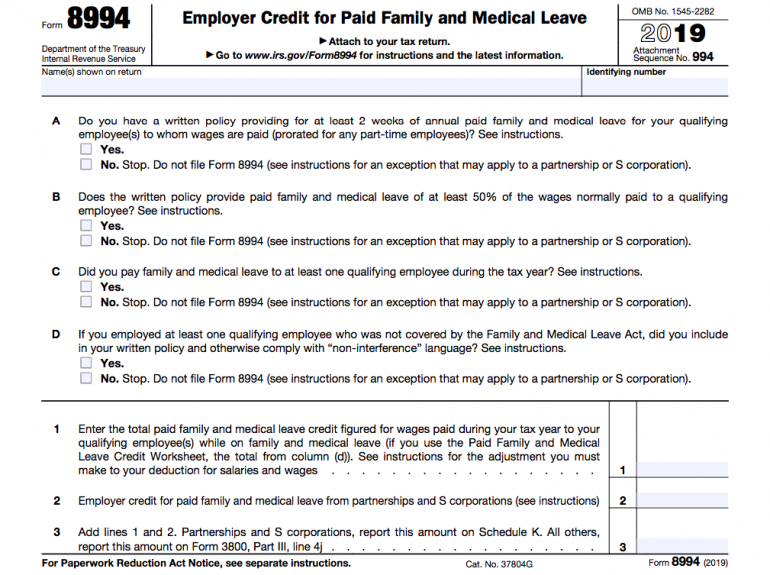

Small Business Tax Credits The Complete Guide Nerdwallet

San Francisco Gross Receipts Tax Clarification

Due Dates For San Francisco Gross Receipts Tax

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

2022 San Francisco Tax Deadlines

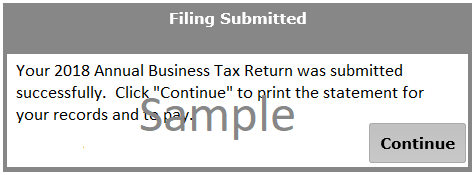

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector